Cryptocurrency And Cybersecurity- A Perfect Game Plan To Secure Crypto

The rise in online transactions and virtual mediums of communication, has given way to an astonishing rise in cyberattacks. As cryptocurrency keeps growing at a faster rate, it draws people with its high-profit potential from traditional banks. With these, comes massive major security concerns. The number of people using cryptocurrency as a payment method or long-term investment is expected to increase to over 300 million in 2024. As of March 2024, there are around 420 million cryptocurrency users globally (Source: bitcoincasinos.com). That is a whopper of a revelation, indeed!

Cryptocurrency and cybersecurity are interrelated in many ways. Being a potentially inviting option for monetary gains, cryptocurrency frauds are becoming increasingly popular among malicious threat actors. As blockchain technology and other industries grow in adoption by businesses around the world; it becomes critical to keep these cryptos safe. Let us dig into this phenomenon and how we can do this in a highly vulnerable threat scenario.

Understanding Cryptocurrency Risks:

Cryptocurrencies are digital tokens that allow people to make payments to each other online without the need for a bank or financial institution. These are not physical and are not issued by a central authority. They use encryption to create an alternative form of payment that is secured by cryptographic techniques.

This also brings massive cryptocurrency related risks including volatility, liquidity risk, hackable exchanges that are not regulated, cyber risks, frauds, fake crypto exchanges, crypto dump and pump practices, operational risks, and many other hacking issues.

How is Cryptocurrency related to Cybersecurity?

Cryptocurrency’s rising popularity has led to an increase in both the sophistication and frequency of cyberattacks. Investors must take precautions to shield their digital assets from bad actors. Cryptocurrencies' decentralized network structure makes hacking and defending against attacks difficult. Investors must, therefore, implement strong security measures to safeguard their assets.

Why is it necessary to safeguard Cryptocurrency?

Being a relatively novel concept of investment and trading in the past decade, cryptocurrency is still flawed with many rising cyberthreat concerns that keep growing in volume and sophistication as well. A solid regulatory framework will protect investors and consumers by safeguarding them against fraudulent practices. Their anonymity and the decentralized nature of the technology have made them appealing to criminals for money laundering, terrorism funding, and other illegal acts. Hence, it is important to safeguard cryptocurrency for the simple reasons, few of which are listed below:

- Greater volatility

- Increased regulation

- Greater assurance and insurance

- Non-Hackability

- Secure digital wallets

- Non-pseudonymous transactions

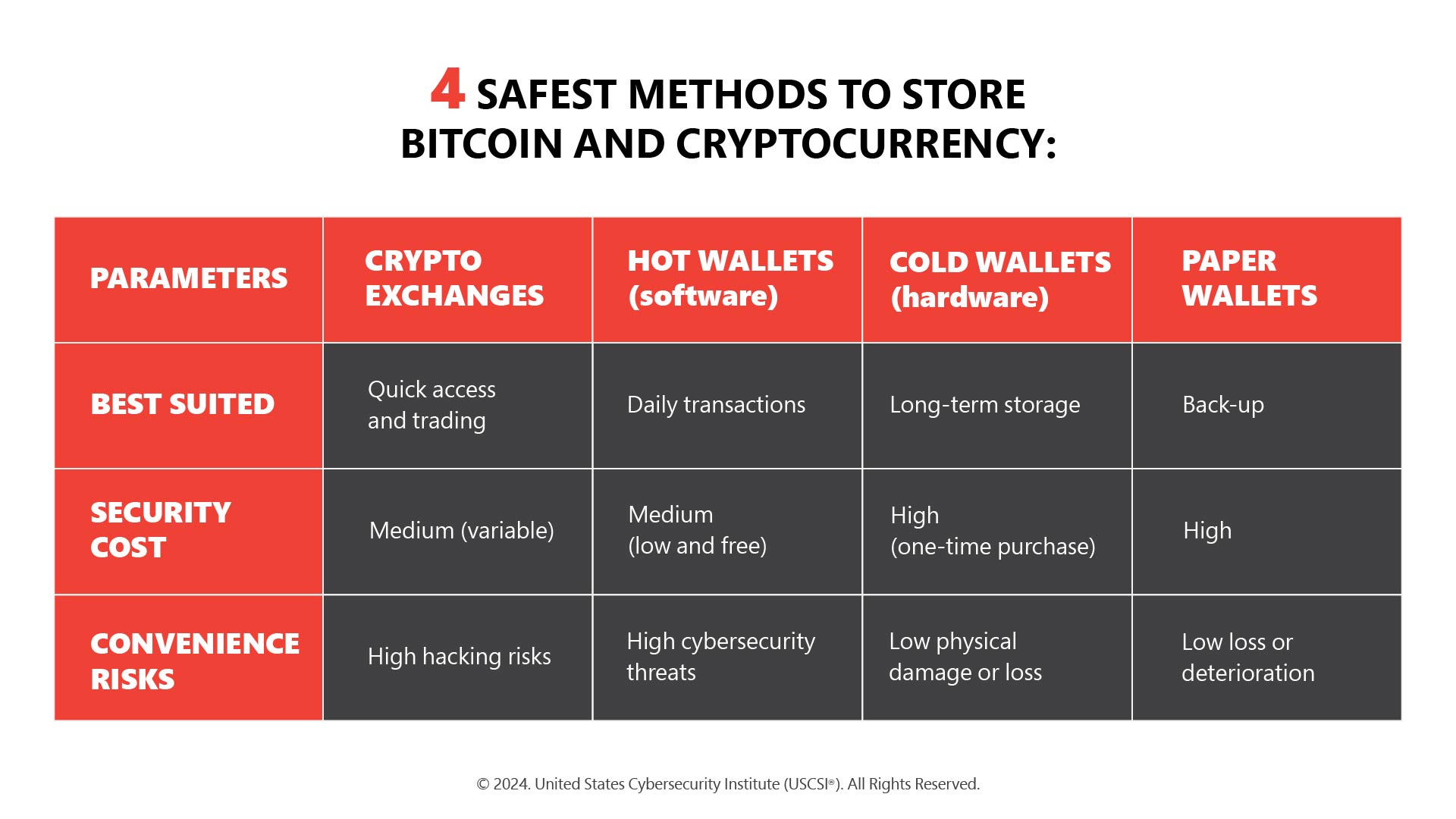

Factors to Consider while Deciding on a Crypto Storage:

- Cryptocurrency- Value and Hold Period involved

Getting to know the total value and duration of your crypto holdings is crucial. A more secure option would be cold wallet for large amounts and long term; whereas a hot wallet is apt for smaller amounts for day-to-day trading.

- Jurisdiction

Laws and regulations affect the storage options as well and ensuring compliance with local laws when selecting a storage solution is a must.

- Security

The level of security you need depends on the amount of crypto and how you use it.

- Ease of use

Your technical expertise and comfort level with cryptocurrency and Bitcoin technology must guide your choice. New users might prefer user-friendly platforms.

- Liquidity

Quick access to your funds is facilitated by liquidity considerations.

- Cryptocurrencies supported

Not all storage solutions support every cryptocurrency; hence make sure you pick the option with specific types of crypto like yours.

- Back-up options

Losing access to your wallet can be devastating and there are solutions that offer secure backup options that can safeguard against this risk.

- Customer service

Great customer service can be critical as you must look for platforms with robust support channels; in the wake of any emergency.

Potential Risks of Storing Cryptocurrency:

- Online hacking

- Physical damage or loss

- Software failure

- Phishing scams

- Regulatory risks

13 Proven Tips to Protect Your Cryptocurrency:

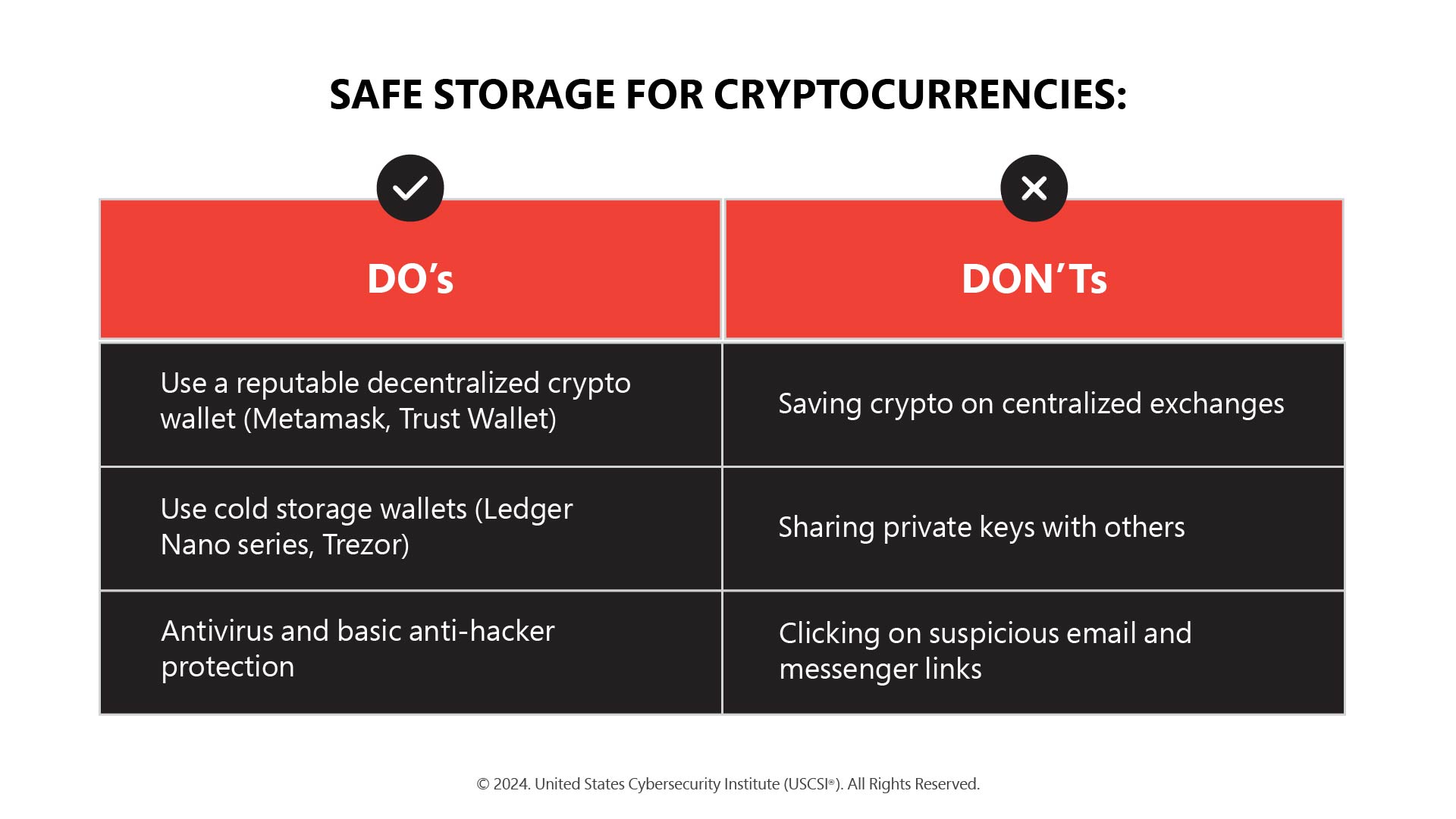

- Choose the right wallet

- Strengthen your passwords

- Implement Two-Factor Authentication

- Beware of phishing scams

- Keep software updated

- Safeguard your private keys

- Backup your wallet

- Diversify your storage

- Stay current with the latest updates

- Consider multi-signature wallets

- Limit exposure

- Plan for inheritance

- Secure your network

Being smart and informed from the very start is the key. Qualified and certified cybersecurity professionals with the requisite cybersecurity certifications and courses can help you big time in securing your cryptocurrency. With the industry expanding at an alarming rate, it is a good time to invest in a cybersecurity career that could last you a lifetime of professional success and beyond.